Sporting Empire Grows, But Definition Remains Elusive

The global sports industry has witnessed unprecedented growth in recent years, with skyrocketing revenues, valuations, and ticket prices that have left fans and investors alike in awe. From the National Football League's massive payouts to each team to the estimated $10 billion valuation of the Los Angeles Lakers' franchise sale last week, consumer spending on sports-related entertainment has never been higher.

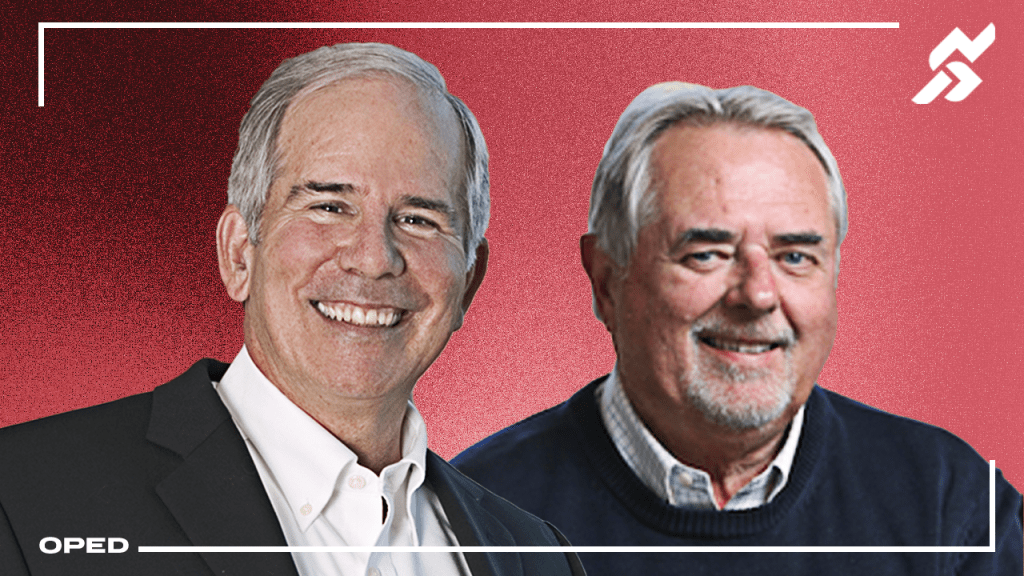

However, as this growth continued unchecked, a key question remained unanswered: just how big is the sports industry, and what lies ahead for its future trajectory? To provide insight into this burgeoning sector, Global Sports Insights experts Dennis Howard and Roger Best, who previously served as professors at the University of Oregon, have developed the Best-Howard Sports Business Model – a comprehensive framework that captures the broad scope and magnitude of the global sports industry.

The Challenges of Measuring Sports Industry Revenue

Historically, estimates of the sports industry's size have been based primarily on revenues generated by sports events. However, these estimates have significant limitations, as they fail to account for broader segments such as sports betting, fantasy sports, esports, sportswear, equipment, and outdoor recreation.

To address this shortcoming, the Best-Howard Sports Business Model incorporates 37 independent revenue sources that are well-defined and measurable. Developed after an extensive review of commercial reports and academic papers providing measures of the size of the sports industry, the model's structure is influenced by Dimitri Mendeleev's Periodic Table of Elements.

The Definition of the Sports Industry

After developing a robust framework for measuring the scope and magnitude of the global sports industry, the authors identified three Sports Industry Domains:

- Fan Engagement: This domain includes 15 revenue segments that capture multiple ways sports fans experience and spend on sports by attending live events, watching sports, engaging in sports entertainment, and others.

- Sports Products: Ten revenue segments are allocated to this domain, producing revenues from consumer spending on sportswear, equipment, and sports health.

- Sports Participation: The final domain consists of nine core areas, with the largest number of revenue sources found within Sports Entertainment.

The Scale of the Sport Industry

Using their defined framework, researchers Dennis Howard and Roger Best estimated that the global sports industry generated revenues of $2.65 trillion in 2023 – placing it among the top ten industries worldwide. This comprehensive assessment offers a reliable overview of the current state of the sports business landscape.

In addition to size measurement, the model also includes documented growth rates for both global sports revenue and U.S. sectors. Detailed participation data along with revenue trends across all 37 industry components are further provided to users.

For stakeholders seeking more complete details on this valuable research framework, a full report is available for $19.95 online or a comprehensive, 367-page book edited by the co-authors may be accessed for $79.50 online and $99.50 print.

"The Best-Howard Sports Business Model represents a new era in understanding the depth and complexity of the global sports industry," declared Dennis Howard, an emeritus professor at the University of Oregon and author of Financing Sport. Together with Roger Best – also an emeritus professor at the same university, author of Market-Based Strategy - their comprehensive model promises to reshape insights in this increasingly valuable market segment.