Investors urged to stick with Systematic Investment Plans (SIPs) as mid-market fund inflows surge

New Delhi, [Date] - In January, the mutual fund industry witnessed robust inflows of assets under management, reaching a staggering Rs 67.25 lakh crore, with midcap funds receiving a significant Rs 5,148 crore and small-cap funds attracting Rs 5,721 crore.

However, amidst this surge in investment enthusiasm, there is growing concern about investors discontinuing their Systematic Investment Plans (SIPs) at a higher rate than new registrations are creating. This has sparked debate regarding the underlying factors contributing to this trend and whether the benefits of SIPs can be missed by leaving investments untended.

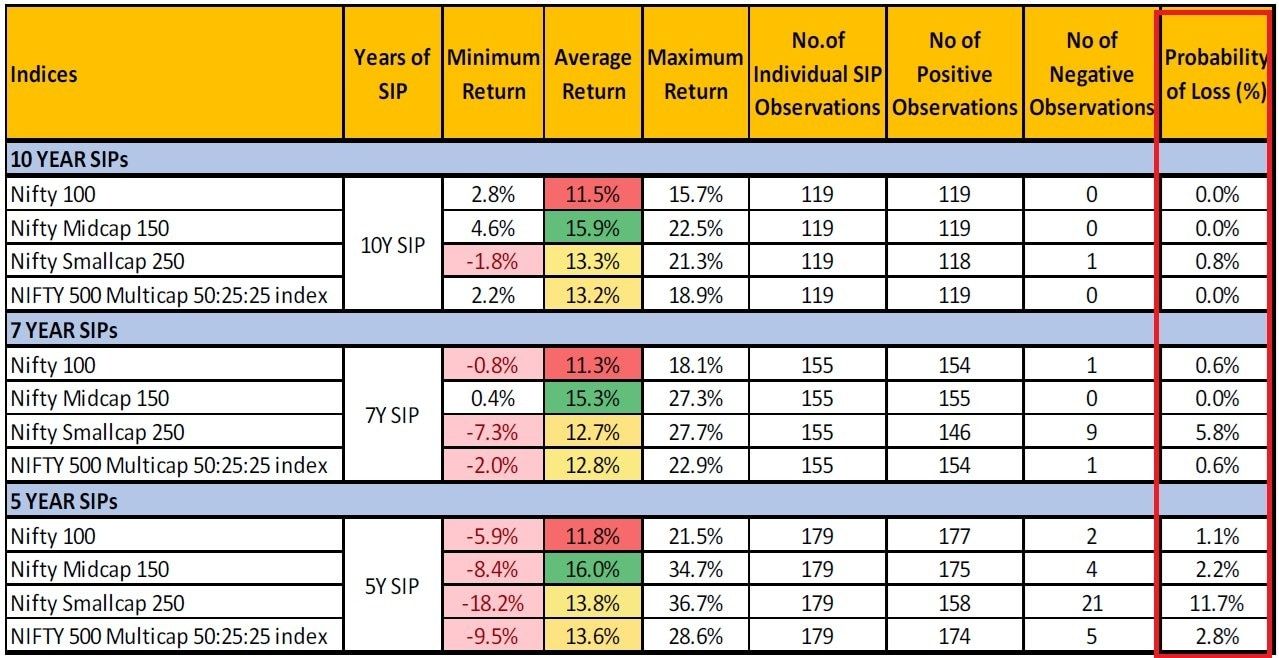

According to Motilal Oswal's analysis, which tracks monthly rolling SIP returns over 5, 7, and 10-year periods for various indices including Nifty 100, Nifty Mid-Cap 150, Nifty Small-Cap 250, and Nifty 500 Multicap 50:25:25, holding onto an SIP for the initial seven years can significantly impact returns, especially in volatile markets such as mid and small-cap stocks.

The report observed that even during pivotal market events like the 2008-2009 financial crisis, the 2013 sell-off, and the recent pandemic, investors who remained invested through challenging periods enjoyed positive returns. For instance, holding onto an SIP for a 7-year period resulted in only a 5.8% loss probability in small-cap stocks.

This analysis makes strong case for retaining investments throughout these trying times instead of being swayed by short-term market fluctuations. Having a 7 to 10-year investment horizon can effectively reduce the risk of losses across various indices, including mid-cap, small-cap and large-cap.

In terms of actual returns, data indicates that extending an SIP from a 5-year period to a 10-year horizon reduced loss probabilities to zero for midcap, zero.8% for small-cap, two point two percent for mid-cap, eleven point seven percent for small-cap over the same period respectively.

Investors are warned that dropping their SIPs prematurely can mean missing out on substantial rewards and potential benefits such as lower risk associated with long-term investments.

When considering an SIP, the initial duration often carries immense influence on performance - for investors opting for mid-cap stocks a 7-year SIP could offer gains while for small-cap stocks only the second three and five years prove crucial.