Caesars Entertainment Seeks Improvement in Q4 Earnings Results Amid Widespread Analyst Optimism

(Reno, NV) - Caesars Entertainment, Inc., a diversified gaming and hospitality company valued at $7.2 billion on the market, is set to release its fiscal Q4 earnings results after the market closes on February 25. The expected profit report has garnered attention from Wall Street analysts who anticipate the company will exceed expectations, defying its inconsistent past performance.

In contrast to its previous quarters' disappointing results, experts predict Caesars Entertainment's loss per share to decrease significantly, down an impressive 163% from a profit of $0.92 in fiscal 2023, to a mere $0.58 in fiscal 2024. However, the company is then expected to report a net income of $1.30 in fiscal 2025, accounting for its dramatic turnaround.

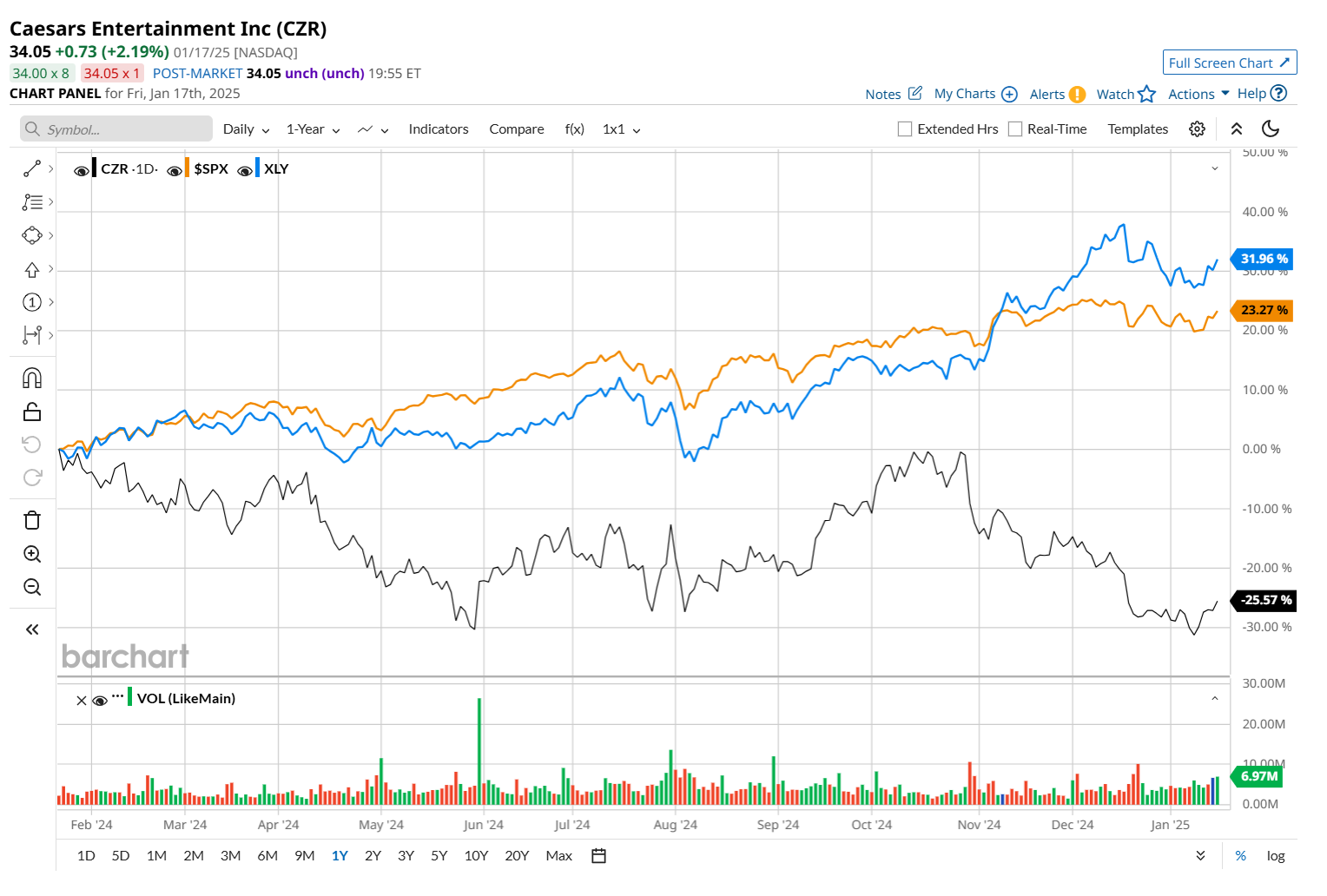

Analysts expect CZR's stock price to rise by at least a marginal amount of 48.1% from current levels based on their mean price target of $50.43. This represents a significant improvement from the 23% decline its shares experienced over the past year in comparison to higher performance from other groups such as Consumer Discretionary Select Sector SPDR Fund, and 26.5% for the S&P 500 Index.

Despite analysts' cautiously optimistic outlook on CZR's prospects, investors should take note that Caesars Entertainment has proven challenging to forecast with its prior performances indicating an inconsistent earnings surprise history.

In preparation of the upcoming announcement, it is advisable to keep up with market news and closely watch future developments pertaining to this gaming business entity.